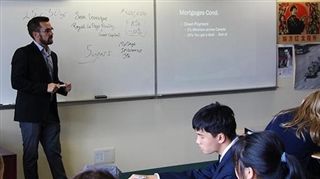

Sean Levesque, a realtor with a BBA in Marketing and five years experience with Royal LePage Coast Capital Realty, dropped by IB Economics 11 to explain the basics of purchasing a home in Canada. Topics, such as mortgages, credit, credit scores, interest rates, down payments and taxes were discussed during the presentation. Additionally, Mr. Levesque showed the students the types of software programs banks and mortgage lenders use when determining mortgages qualifications, which inevitably led to an active discussion on debt servicing and the value of learning to live within one’s means. During the second half of the presentation, the students were divided into groups each earning different annual incomes. Once they were pre-approved by Mr. Levesque, using the mortgage software previously shown, the students were asked to research the website Realtor.ca to find a home within the Greater Victoria Region. To many of the students’ surprise—even those earning $30 per hour—they were unable to find more than a handful of properties within their price range. This very real problem was exacerbated when students were asked to add in additional costs such as realtor fees, the Property Transfer Tax, house insurance, and mortgage insurance if they were unable to put up a 20% down payment. Some of the big lessons learned by the IB Economics 11 students were:

- Buying a home is more complicated than they thought.

- The cost of buying a home includes much more than just the asking price.

- Earning $17 an hour may cover the cost of a few cheeseburgers and movie tickets, but won’t allow you to afford very much in the Victoria real estate market.